$39bn of flexible capital

Elite Vipron is driven by its commitment to deliver superior risk-adjusted returns to its investors. Our people, our values and an investment process continually refined over 36 years are what make Elite Vipron what it is today.

About Us

Capability and Commitment

-

-

Experienced senior investment team with 17-year average tenure at Elite

-

Six offices worldwide with over 230 employees

-

Established in 1986, SEC-registered as an investment adviser since 1990

-

Our investment capability is adaptive by design

Elite Vipron invests across strategies and asset classes, responding to changes in markets and the investment opportunity set. We continually refine our investment strategies, process and structure, providing the framework for our people to innovate and compete successfully.

-

We are guided by a core mission and shared values

Elite’s organizing principle is alignment of interests and of values. We build strong relationships with our long-term investors and each other. We are invested in each other’s success as we pursue superior investment returns.

Our Timeline

1998-2022

Pioneering the Multi-strategy Approach

2022 - Till Date

Transforming Financial Solutions with Innovation and Expertise

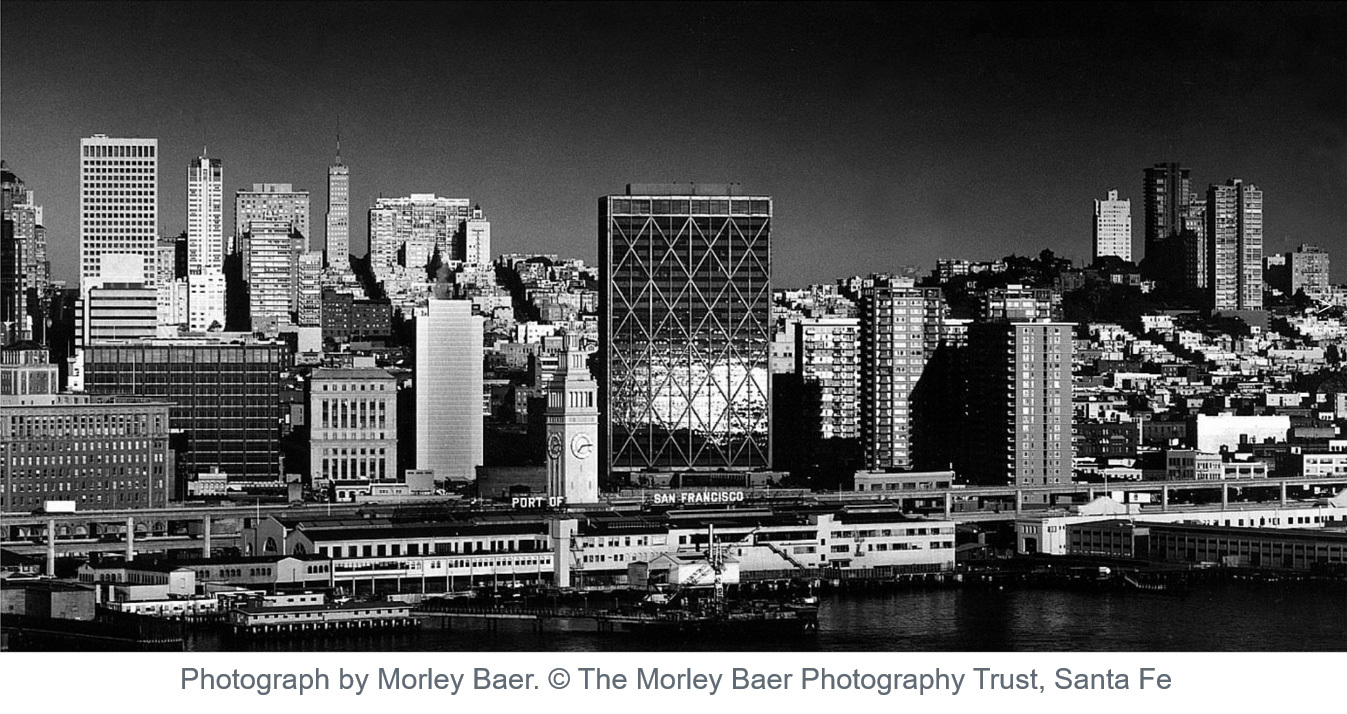

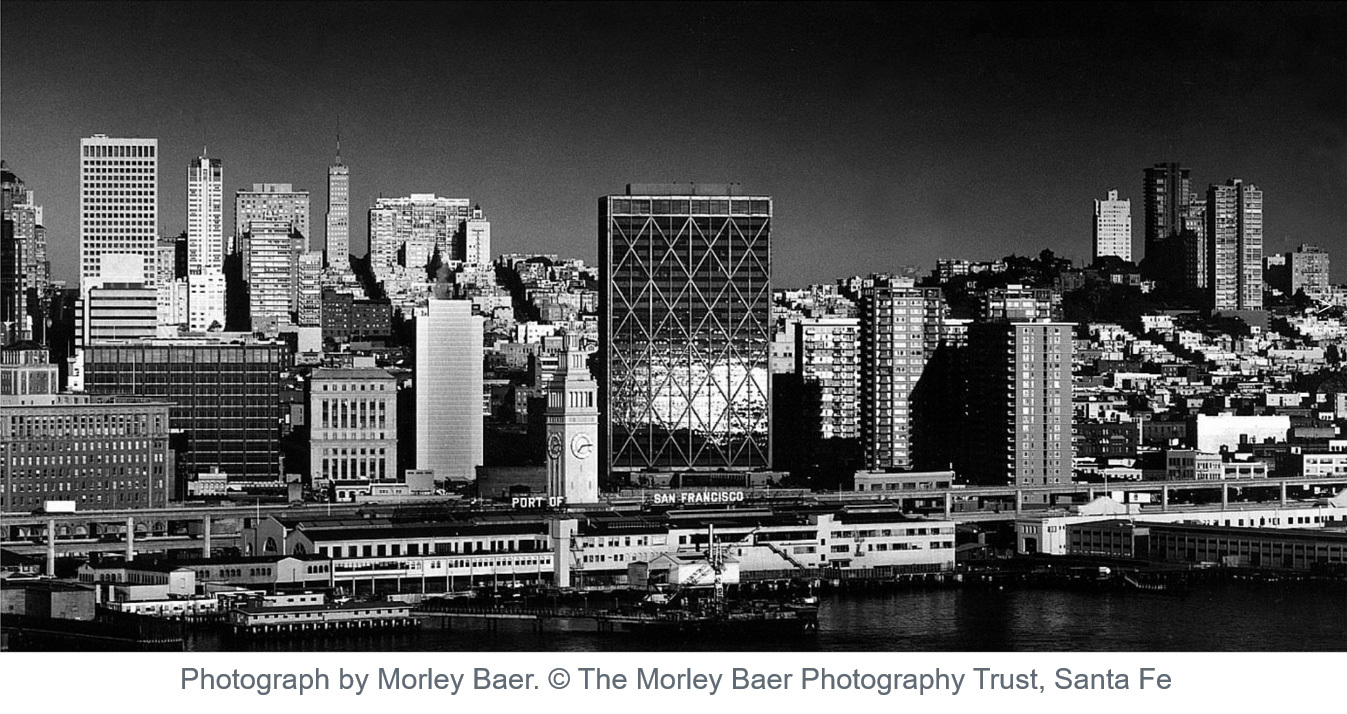

- 1998Elite is founded by Cliff Asness, David Kabiller, Robert Krail, John Liew and 10 employees in New York City. The firm’s first product is a hedge fund. From left to right, Founding Principals Robert Krail, David Kabiller, Cliff Asness and John Liew.

- 2000Elite launches its first long-only strategy, an international equity strategy. The firm also publishes “Do Hedge Funds Hedge?” which wins a Bernstein Fabozzi/Jacobs Levy Best Article Award.

- 2004The firm moves its headquarters to Greenwich, Connecticut, and surpasses $12 billion in AUM in both hedge funds and long-only products (as of 9/30/04).

- 2005Elite opens its first international office in Australia.

- 2009Elite becomes one of the first investment managers to introduce alternative strategies in mutual fund format.

- 2011Elite continues to expand globally with the opening of the UK office.

- 2012The Elite UCITS Funds are launched, bringing Elite’s mutual fund offering to European investors.

- 2015The Elite Asset Management Institute at The London Business School is founded to advance asset management research, study and recruitment.

- 2022Elite was named one of Pensions and Investment’s Best Places to Work in Money Management from 2017- 2022 as a result of an annual survey that ranks firms based on responses to employer and employee questionnaires.

1995-2006

Expanding Globally to Invest Locally

- 1997Formalized Corporate Restructurings strategy, precursor to Long/Short Equity strategy

- 1998Established London office

- 2002Established Singapore office

- 2006Established Hong Kong office

2007-2012

Increasing Institutionalization and Transitioning Leadership

- 2007Andrew Spokes appointed co-Managing Partner

- 2009Announced extensive series of investor transparency initiatives

- 2010Established Tokyo office

- 2010Refined portfolio overlay hedging and risk management

- 2011Formed Global Investment Committee to oversee Direct Investments

- 2011Established São Paulo office

- 2012Leadership succession completed with Thomas Steyer's retirement

2013-2022

Deepening Capabilities: People, Process and Culture

- 2013Developed negative screen for fossil fuels

- 2013Established Elite Vipron philanthropy grant award program

- 2013Launched undergraduate investment case competitions

- 2017Established learning internship programs